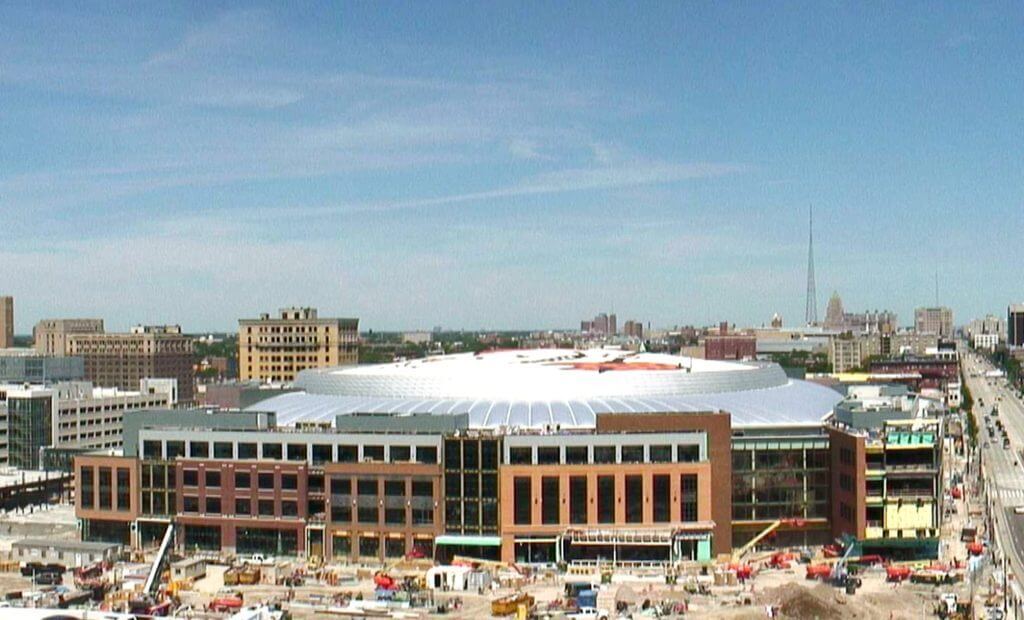

Part of the legacy of the late Mike Ilitch, founder of Little Caesars Pizza and owner of the Detroit Tigers and Red Wings, is taking shape at I-75 and Woodward Avenue in the heart of the city.

Little Caesars Arena — part of what city officials hope will be a thriving 50-block District Detroit — is scheduled to open this September with five Kid Rock performances. The Detroit Red Wings will play their opening game at the arena on Oct. 5 against the Minnesota Wild.

The District Detroit, spearheaded by Ilitch Holdings Inc. and its real estate arm Olympia Development, will be home to five neighborhoods, six theaters and three professional sports venues. The $1.2 billion project is expected to have a $2.1 billion total economic impact on Detroit, the region and Michigan, according to the project website.

Over 500 industrial theaters and three professional sports venues. The $1.2 billion project is expected to have a $2.1 billion total economic impact on Detroit, the region and Michigan, according to the project website.

A full build-out of the development will take years to complete. Cost of the arena alone is reportedly now up to $863 million, according to local media reports.

“The newly developed district will become a central hub for entertainment and residential in the city,” predicts Albert Ellis, senior associate at Southfield, Michigan-based Farbman Group. “It is a much-needed connector between the CBD and Midtown areas. It is nice to see the level of investment that is going into the district.”

The District Detroit will connect Downtown to Midtown via the QLine Streetcar line. The 3.3-mile street car opened to the public on May 12 after a decade-long effort by backers in the public and private sector to bring the $142 million project to fruition.Billions of dollars in investment will continue to support development projects along the streetcar’s path on Woodward Avenue, according to M-1Rail, which owns and operates theQLine.

“Since the launch of the QLine in May, it’s been very exciting to be downtown,” says Elyse Turner, director of marketing at Detroit Labs, an application development company located on Woodward Avenue. “I only see the efficiency and use of the QLine to reach businesses increasing as we adapt to the new form of transportation.”

Woodward Square, one of the five neighborhoods within The District Detroit, will house Little Caesars Arena. Both the Detroit Pistons and the Detroit Red Wings will call the 819,000-square foot arena home beginning with the 2017-2018 season.The Wayne State University Mike Ilitch School of Business will also be located in this area. Funded mainly by a $40 million gift from the Ilitch family, the school is slated to open next year.

Delaware North Sport service, a division of hospitality and food service provider Delaware North, has been awarded the contract to serve as the food, beverage and retail partner at Little Caesars Arena. The company will provide concessions at more than 50 stands as well as premium dining services for club areas and suites.

A 9,500-square-foot team store and a 19,000-square-foot District Market restaurant and bar will anchor the arena’s retail component. Delaware North is also the food service provider for Comerica Park, home of the Detroit Tigers.

Concessions at Little Caesars Arena will include fresh foods at District Market

Express; chicken and fries at The Coop; locally based brewery offerings and craft cocktails at 1701 Pub; and regional favorites like coney dogs and shawarma at Detroit House.

Who’s expanding, thriving?

Though specific retailers have yet to be announced for The District Detroit, industry experts are weighing in on who is likely to open in the area and at what cost. “It appears Detroit is poised for some incredible redevelopment, including more dwelling units in the urban core, more retailers and specialty restaurants — many that will tap into Michigan’s craft beer and spirits industry — as a result of the District Detroit development,” says Rod Alderink, principal and associate broker at NAI Wisinski of West Michigan.

Though specific retailers have yet to be announced for The District Detroit, industry experts are weighing in on who is likely to open in the area and at what cost. “It appears Detroit is poised for some incredible redevelopment, including more dwelling units in the urban core, more retailers and specialty restaurants — many that will tap into Michigan’s craft beer and spirits industry — as a result of the District Detroit development,” says Rod Alderink, principal and associate broker at NAI Wisinski of West Michigan.

According to Alderink, the retail sector is extremely active in Michigan, with both regional and national names seeking locations and expansion opportunities.

The types of retailers most frequently expanding in the Detroit market include discount department stores as well as those specializing in health and wellness, according to Alan Stern, vice president of brokerage services at Farmington Hills, Michigan-based Friedman Integrated Real Estate Solutions.

Off-price stores such as TJ Maxx, Five Below and Nordstrom Rack are often the beneficiaries of department store closings, which have been well documented across the country this year. The

rise of e-commerce is often cited as the biggest reason for the large number of store closures.

But by focusing on customer service and product offering, retailers can stay in the game, notes Stern.

“Don’t count out traditional retailers,” says Gabe Schuchman, partner at the Michigan office of Mid-America Real Estate Corp. “They will have to adjust their footprints and business models possibly, but those that figure out the right balance between Call for an immediate consultation. e-commerce and brick and mortar should be able to thrive in the new retail environment.”

Meegan Holland, vice president of communications and marketing at the Michigan Retailers Association, says that unlike much of America, Detroit is under-retailed. “So, it’s exciting to see the number of stores opening here, especially in Midtown. And it’s paying off.

Many Detroit-made products have garnered national attention,” she says.

Holland names Detroit-based Shinola, the lifestyle brand specializing in watches, bicycles and leather goods, and Jack White’s Third Man Pressing as examples. The Detroit born singer’s vinyl record pressing plant opened in February.

As for The District Detroit, Holland says that the development’s location near professional sports venues means that the commercial scene will extend beyond tourism.

“With 700 apartment units planned, there’s potential for urban markets, drugstores, dry cleaners and other service-based businesses. It will make for a very diverse and vibrant neighborhood,” she explains.

The Michigan Retailers Association maintains a permanent campaign entitled “Buy Nearby” to promote Michigan retail businesses and communities. According to Holland, the campaign is resonating particularly well with millennials who like shopping at local stores that incorporate a fun experience with good customer service.

But opening stores in the downtown area may not be financially feasible for local brands. Stern of Friedman says that rental rates in the downtown area (high $20s to mid $30s per square foot triple net) are too high for local retailers.

“Only national [brands] can support that type of occupancy cost. It’s very difficult for mom and pops to sustain those types of rental rates,” he says.

Ellis of Farbman Group echoes this sentiment. “For smaller tenants, it is becoming a challenge to find suitable spaces in the CBD and Midtown areas. Lease rates have climbed significantly,” he says.

Examples of retailers with store locations in downtown Detroit include Under Armour, Nike and Shinola.

Hurdles ahead

In Stern’s opinion, the restaurants will stay busy but the retail sector will have a tougher time attracting foot traffic. This is mostly due to the younger residents living downtown, who are at work during prime retail hours. Stern does not see downtown Detroit as a family-oriented city at this time.

In Stern’s opinion, the restaurants will stay busy but the retail sector will have a tougher time attracting foot traffic. This is mostly due to the younger residents living downtown, who are at work during prime retail hours. Stern does not see downtown Detroit as a family-oriented city at this time.

The plus, however, is that employment is up 1.8 percent metrowide from last year. Detroit employers are on track to generate 35,000 positions this year, including 15,000 office-using jobs, according to national real estate brokerage firm Marcus & Millichap.

The largest hurdle to Detroit’s resurgence, Ellis believes, is attracting more Fortune 500 companies. Not many large corporate tenants, credit card companies or established tech companies have taken more than satellite office space in the city.

“If the rebound is going to be sustainable, the state needs to do a better job of enticing these types of tenants to invest in the city of Detroit,” Ellis insists.

In May, Olympia Development unveiled the first phase of residential development at The District Detroit, featuring six buildings. The plan includes the redevelopment of four existing buildings — The Alhambra, The American, The Eddystone and 150 Bagley — as well as the construction of two new buildings.

Of the 686 total units, 139 will be designated as affordable housing for those making no more than 80 percent of the area median income. This Woodward Square, one of the five neighborhoods within The District Detroit, will house Little Caesars Arena. The area outside the

arena will feature retail and restaurant space, as well as a gathering area for activities and events. is Detroit’s single largest project of new market-rate apartment units, affordable

units and redeveloped historic buildings in more than 20 years, according to project developer Olympia Development. Construction of the new buildings is expected to begin later this year, with the renovation of existing buildings beginning in 2018.

Only time will tell the impact that The District Detroit has on rebuilding the city’s image, but generations of Detroiters owe a debt of gratitude to the Ilitch family, sources agree.

Ilitch died on Feb. 10 at the age of 87. With $10,000, Ilitch opened the family’s first pizza store in 1959. The Ilitch companies now include Ilitch Holdings, Little Caesars Pizza, Blue Line Foodservice Distribution, the Detroit Red Wings, the Detroit Tigers, Olympia Entertainment, Olympia Development, Little Caesars Pizza Kits Fundraising Program and Champion Foods.

“Mike Ilitch’s greatest contribution to Detroit was his steadfast devotion to it,” says Andy Gutman, president of Farbman Group. “He invested when it seemed very few still did. His actions, and those of his family and organization, have served as a beacon of hope for the city.”